undamentally, how we learn is changing. Increasingly, in a world in which knowledge is doubling every 13 months, knowing how to continuously learn is more important than the reputation of the institution that granted one a degree. Skills and the ability to consistently upgrade them are becoming more important than credentials. The consequences are profound. As the late Prof. Clayton Christensen noted, 50% of US colleges are headed for bankruptcy in the coming decades.

To be sure, this is due not just to technological shifts but to an obsolete business model. The extreme costs of higher education in the United States are such that prospective students are hesitant to embrace the lifetime of debt that they will be required to carry when there is no guarantee of employment and the imperative to repay that debt can actually restrict the types of job opportunities that one can pursue. If your goal is to take a teaching job with modest compensation, can you really afford tens of thousands of dollars in student loan debt for a graduate degree?

In addition, there are concerns about admissions standards. For all of the high-profile discussion over affirmative action in admissions to elite universities, the dirty secret that is less widely discussed is that wealthy applicants are far more privileged during the application process with unchallenged policies such as legacy admissions and alumni preferences. Technology is increasingly providing an answer to these challenges. Just as digital technology has lowered costs and produced enhanced flexibility with new capabilities in many industries, it is now doing the same in the foundational sector of education.

This trend has been accelerated by the COVID-19 pandemic which induced schools and parents to experiment with new technologies and innovative educational models or risk having children fall behind in their educational development. That trend along with the maturation of key technologies means that we are now in the middle of a genuine revolution in edtech (education + technology).

Edtech can be defined as the combined use of advanced hardware and software technologies—usually digital but also including augmented reality, virtual reality, artificial intelligence, and other related innovations—to facilitate and enhance learning. The deployment of these technologies makes different educational models and practices possible.

For example, instead of a brilliant teacher being accessible only to those fortunate enough to be able to attend that specific teacher’s university, their classes can be translated and made accessible globally to all in real time thereby exponentially expanding the reach of their expertise while producing the possibility of greater rewards for that individual. Advantages also accrue to the student as edtech-enhanced learning makes it possible to more accurately diagnose problem areas that require attention.

In a math test taken online, it is possible to time how long a student spends answering specific types of math questions so as to quantify which aspects of the mathematics curriculum the student needs to study harder on and which areas the student has already greatly mastered. It is in this way that learning can become more personalized, which is increasingly regarded as the best learning path since all students are clearly not the same in terms of capability and aptitude.

The data that is gathered can be used to generate a personalized learning regimen that is best suited to the needs of that specific student. Likewise, the onerous practice of notetaking can be facilitated with digital blackboards and automatic transcription tools that can accurately and efficiently transmit the content of the classroom directly to a tablet or mobile device. Finally, as is the case with all digital technology, edtech makes it possible to remove the constraints of time and space. One can study anywhere and anytime instead of being forced to learn at a specific time and locale that may not be best.

This flexibility frees both the student and the teacher while lowering fixed costs since less money needs to be spent on the real estate required to host a classroom lesson. These are just a few of the advantages that edtech offers for revolutionizing education—an activity that is so basic to our lives that there will always be inelastic demand for it. Immense markets with inelastic demand represent the grand slam investment opportunities that venture capitalists adore.

Critical Drivers

The maturation of a technology stack is seldom enough to induce changes in consumer behavior, particularly with regards to an activity as fundamental as education. In the United States, the critical issue driving the embrace of edtech is debt. Over the last decade, as the US economy has become more and more heavily financialized, student loan debt has increased by 66% to an astounding $1.77 trillion. This is an increase that is almost 500% of the consumer price index:

As a consequence of the massive debts incurred, 36% of graduates believe that college wasn’t worth it and 43% of graduates are underemployed. Education as a “product or service” is failing in America and there is a search afoot for lower cost alternatives that better meet the needs of clients in terms of matching skills that must be constantly upgrading to the ongoing changes in the job marketplace. Edtech offers potential answers to these structural challenges in the American economy.

On the one hand, Americans need education or more precisely access to continuous learning but it cannot be offered at such a price that obtaining it forces one into a life of debt peonage and restricted financial opportunity. The hope is that venture capital-financed edtech along with innovative entrepreneurship can develop solutions to address this fundamental problem.

COVID-19: The Black Swan Event

The COVID-19 pandemic has acted as a powerful digital accelerant inducing the adoption of the latest technologies in the education market while also facilitating long-needed changes in traditional behavioral patterns as it relates to learning and education. Prior to the pandemic, the kindergarten through high school educational system was essentially operated on a centralized, command and control 19th-century factory model with all students forced to learn at the same speed, in the same place and at the same time. The ability to detect and address individual nuances was limited.

Either you passed an exam or you didn’t but the capacity to understand the totality of a student’s true strengths or weaknesses was mitigated by the inability to focus on the individual. This is why so many students remember fondly the specific teacher who took a special interest in them and helped to hone and shape their unique capabilities or overcome a particular challenge they had. Reaping the benefits of individualized, personalized learning was not a feature of the educational system but a matter of luck. A similar phenomenon occurred in higher education but there were differences.

If a student elected to attend a larger—and probably cheaper—state school then the prospects of receiving personalized instruction in classes with hundreds of students of students was minimal. But if a student could afford to attend a more expensive small liberal arts college with dozens of students per class, then it would be possible to obtain a modicum of personalized instruction. However, the most popular, elementary classes that were difficult and essential like Calculus I or Computer Science I normally did not meet that requirement. It is only as a graduate student that one could truly be mentored but graduate students are by definition already the best so they are the least likely to need it.

COVID-19 has changed this. It has forced adoption of the digital technologies and edtech business models that make scalable, personalized learning possible. The online tests and practice materials don’t just determine if an answer is right or wrong, they can assess the amount of time spent answering the question, categorize them, and provide feedback. The artificial intelligence and machine learning algorithms can also track a student’s responses over time to see if the student is improving or use alternative wording for specific types of problems to help isolate why a student gets so confused about a particular concept.

All of this can be sent to a teacher to help develop a more personalized curriculum that is best suited to the specific needs of that student. One can even isolate if the specific time of day that the student is taking the exam impacts their exam performance. Also, some students benefit from different types of learning formats. Some students are very literary and prefer to read intensely so as to best ingest information while other students benefit the most from visual communication or even having the material explained via oral commentary. The key is to match the style of teaching to how that particular student’s brain is wired to get the best pedagogical result.

Finally, aside from incentivizing the shift towards personalized learning, which is a better model, the COVID-19 pandemic has highlighted the poor cost structure/model of many universities. The debt and fees imposed on students have been used to finance a huge building boom on campuses across America.

These new buildings represent a huge fixed cost that cannot be maintained. Just as COVID-19 has led to an ongoing collapse of the commercial real estate market, the truth is that the rise of increased distance learning and other edtech solutions as well as reduced desire to take on higher education debt means that it will simply not be possible to maintain all of these buildings and facilities. This is especially true because COVID-19 led to reduced travel and the foreign students who pay a premium to attend American universities were unable to come to the US.

This change is not cyclical but structural. As living standards rise overseas, the willingness of the top students from China and India to relocate to the United States when they can get a high-quality education in their homeland is diminishing. Why leave booming economies when you can get a good education in an emerging market and be well positioned to immediately enter your domestic labor market?

The EdTech Market

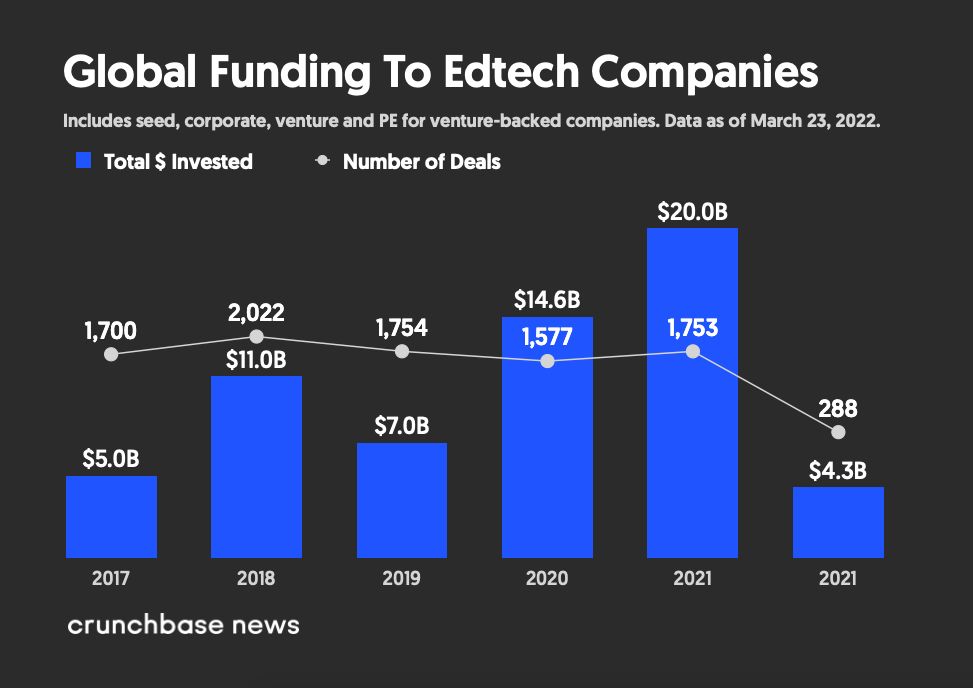

How big is the edtech market? As of 2023, the global edtech market is valued at approximately $121 billion and is expected to grow at a CAGR of 19.1% to reach $348 billion by 2031. During the 2020-2021 height of the COVID-19 pandemic, the shift towards a study from home posture led to an explosion in edtech venture capital funding with a doubling between 2019 and 2020, and a further 25% increase in 2021 before cooling off:

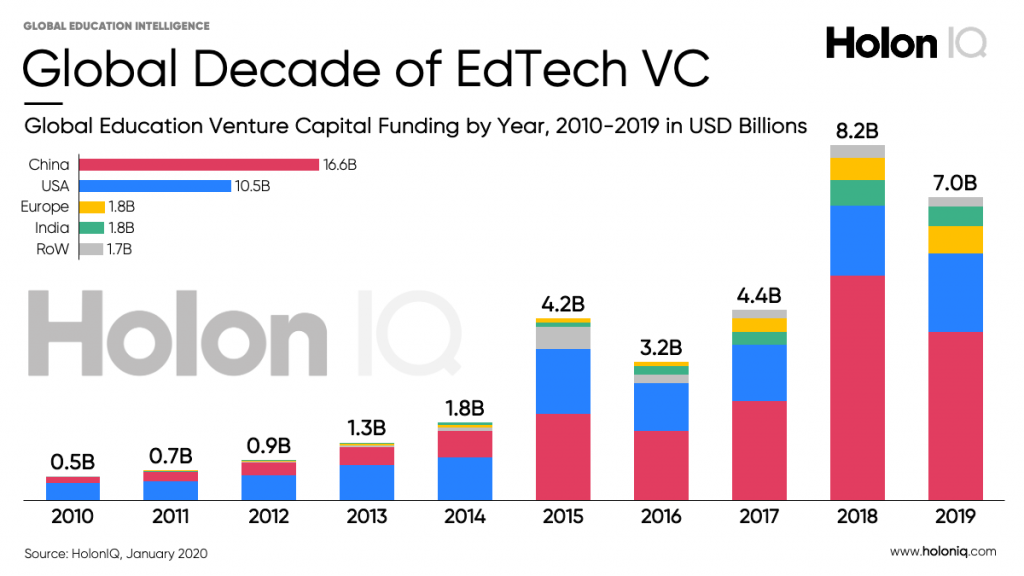

However, even before the dramatic increases of the pandemic, venture capital funding of edtech had been rising:

Between 2010 and 2019, the US has experienced $10.5 billion in venture capital funding of edtech. In addition, the edtech market has become increasingly globalized:

As is evident, the Chinese edtech market has exploded and venture capitalists have invested accordingly with China obtaining $16.6 billion in edtech financing from 2010- 2019, which makes it the largest edtech market in the world. This is not surprising as the country is developing rapidly which produces increased demand for skills and there is a long-standing tradition of profound respect for educational attainment. India has also grown from a low base to achieve a tie for third in edtech funding with Europe.

What is particularly unique about India is that the huge number of highly educated English speakers in the country has made it a promising locale from which to source low-cost tutors to serve students in developed countries. In this way, edtech is a part of the ongoing technology services revolution that is a lynchpin of India’s modernization drive. However, this trend of rising investment in edtech is on the decline.

As is the case throughout the venture capital industry, funding has decreased due to rising interest rates and concerns that there is a need for greater investment caution as investors anticipate a global recession. 2023 VC funding in edtech is forecast to decline dramatically to $3.5 billion from $10.6 billion in 2022. Indeed, the current challenges in the edtech market are exemplified by the experience of Byju, an Indian company that is the global market leader in edtech. Once valued at $22 billion, Byju is now valued at $5.1 billion and it is now facing layoffs and myriad economic challenges as the post-pandemic edtech markets dramatically readjust.

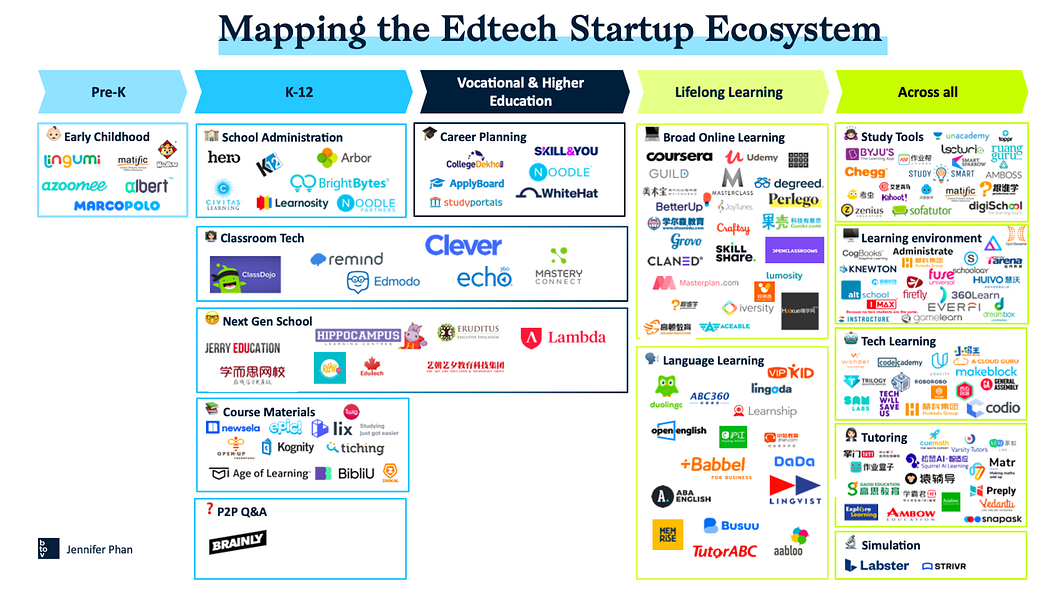

There are a wide variety of market niches in the edtech industry. These niches start with the very young and gradually expand to include “universal education”—a catch-all category that is applicable to all adults. This edtech ecosystem can be encapsulated as follows:

- Pre-Kindergarten: This refers to early childhood edtech. The focus tends to be on facilitating exploratory learning by toddlers since their brains are not prepared for anything structured. A leading company in this space is Neobear, a Chinese firm that uses augmented reality technology to develop intelligent toys for children. Another company is Learn With Homer, which is focused on accelerating the reading and mathematical development of children aged 2 to 6 with personalized apps embedded in tablets that adapt to the learning style and pace of the child using it. The company raised $93 million in venture funding.

- Kindergarten-12/High School: This is the market segment that saw the biggest boost in the implementation of edtech during the COVID-19 pandemic. Budget-strapped high schools who were constrained by laws and outdated behaviors were forced to innovate by the pandemic or risk having students fall behind during the year long pandemic. Classes over Zoom became commonplace and online testing was initiated which in turn demonstrated the catalytic impact of personalized learning and AI-enhanced diagnostics. Because of the huge size and complexity of this market segment, it includes not just edtech to facilitate better teacher to student relations but also digital class materials and technology to lower the cost structure of school administration while also enhancing its efficiency. The vast majority of public education spending is in this area so the market opportunities are immense. In the UK, Arbor is a cloud-based. education operations company serving 5,000 schools that is a pioneer in facilitating the increasingly complicated tasks inherent to the daily administration, record keeping and communications mandates of schools. In the US, on the education operations side, Swing Education has raised $38 million to help address the teacher shortage challenge by producing a platform to match substitute teachers with difficult to find positions. Brainly is an AI learning platform that is designed to help students with their homework. A major trend in the edtech space at the K-12 level is gamification. Platforms like Quizlet have revolutionized learning by transforming education into highly interactive and fun games that put joy into learning. Even large companies like Google have entered into edtech. Through Google Classroom, the company is helping to manage classroom tasks and promote streamlined communication between education stakeholders including students, teachers and parents.

- University Education: Top schools like Stanford and MIT are increasingly monetizing the knowledge of their professors with online course degrees. They are also using edtech to support the development of their students. Notes are disseminated online. Videos of classes are available online as well for students to review materials. It is also increasingly possible to take online practice tests. In addition, to circumvent cheating on homework, programs---most notably in computer science—have implemented fraud detection schemes that can automatically scan for similarities in the code submitted by students to ascertain the likelihood of cheating having occurred. At the same time, it is an ongoing arms race as generative learning programs like ChatGPT have become so ubiquitous that it is becoming ever more difficult to determine who is not using a computer to help with an assignment.

- Lifelong Learning or Online Learning Platforms: This is what one typically thinks of when considering edtech. Online course catalogs like Coursera, Udemy, Skillshare and Masterclass offer course for a fee but that fee is much less than a course at a physical university and the course can be taken with great flexibility on the students own time. There is an incredible array of content available on these platforms so variety of discipline is the other advantage. Some are even taught by teachers with professional backgrounds from Google, Microsoft and the like so they are able to offer “micro-degrees” that have genuine credibility in the workplace. Edtech has advanced to the point that an online credential can be as valuable as a physical one.

- Across All/Vertically Integrated: Some edtech companies seek to be vertically integrated by cutting across all of the aforementioned verticals or providing technology that makes it possible for them to operate on the backend. For example, Schoology and Everfi provide learning environment technology or learning management system software platforms that enable school to administer and share content and learning assessments. Chegg is 17-year old edtech company that now generates $767 million in revenue by providing digital textbooks, online tutoring and student support services. Newsela, which serves over 37 million K-12 students, converts news stories and texts from sources such as the Associated Press and the Encyclopedia Brittanica into personalized content that is accessible to a particular student’s reading level while being aligned with state education standards. Other companies like Byju provide study tools and technologies that enable personalized learning programs at all levels.

Each of these edtech market segments has their own customer base with specific characteristics that must be addressed to meet their needs. They also have stakeholders who companies must work with. The startups and venture capitalists who seek to be active in edtech must be sensitive to this. Even an educational tool, if poorly designed, can be harmful either physically or even intellectually; and the risk increases the younger the target population. The issue with edtech is that one is dealing with a basic human activity—facilitating or potentially constraining the cognitive development of people. Therefore, great caution is advised no matter how innovative the technological advancement that has been conceptualized.

What VCs are Funding Edtech?

There are a wide variety of entities that have emerged as leading venture capitalists in the edtech space. One of the leaders is a decidedly non-traditional venture capital fund. The NewSchools Venture Fund is nonprofit national venture philanthropy fund that has invested approximately $200 million in over 200 education startups. NewSchools invests at all levels—pre-seed, seed, Series A, and Growth. Investments include ClassDojo and Uncommon Schools. Their thesis is: “We are the first venture philanthropy focused on K-12 education. As a nonprofit and intermediary funder, we raise charitable donations and then grant those funds to early-stage entrepreneurs who are reimagining public education. While we have a rigorous investment process, we seek educational and social returns, not financial ones.” In other words, they are not just in it for the money.

Owl Ventures is in it for the money. Founded in 2014 and with $2 billion in assets under management, Owl Ventures is the largest venture capital firm in the world that is focused exclusively on edtech. It is based in Silicon Valley with a mission to assist in the scaling of the world’s best edtech companies including those at the pre-kindergarten, K-12, and university level.

Their thesis is: “We believe there is a digital revolution rapidly unfolding in education and workforce development. This revolution is creating a historic opportunity to invest in companies that are disrupting and improving the over $6 trillion global education market. The entire education and training sector is shifting rapidly as access to the internet and connected devices has flourished. Hundreds of millions of students and teachers around the world can now leverage innovative learning platforms.” They invest at all stages—seed, early, growth and late; and both domestically as well as internationally. Investments include Khan Academy, Schoology, Masterclass and Knewton.

Established in 1999, Bonsal Capital has focused on mission-driven entrepreneurship, especially tech-enabled services in education and as such has invested in Upswing, Nepris and Everyday Labs. Learn Capital is a multistage venture capitalist that has focused on platforms such as Udemy and Coursera as well as edtech course material companies such as Chegg.

While not exclusively focused on edtech due to its investments in Airbnb, the Honest Company, Stripe and others, General Catalyst is a larger VC that has made investments in edtech companies like Chegg, Coursera and Udacity. GSV Ventures is focused on seed and early-stage venture investments for firms committed to disrupting the education industry. In addition to capital, the San Francisco based VC provides market analysis, distribution support and strategic advice. Portfolio companies include Outlier, Degreed, and Guild Education.

A highly successful edtech venture capitalist is New Markets Venture Partners which is based in Fulton Maryland. Its investments at both early stage and late stage. Its over 40 portfolio companies have over $3.2 billion in enterprise value. The company specializes in edtech oriented around 21st century skills, and workforce prep. This is in tune with the trend away from credentialing towards continuous education oriented around that with practical utility in a rapidly changing workplace. As such they are interested in companies that have already shown product-market fit, demonstrated scalable growth and are impact-focused with proven efficacy. Portfolio companies include Climb Credit, K2 Integrity and Nextford University.

Demographics will play a critical role in edtech. This is a global business. The emerging Asian middle class is now coming into its own in India, China and Indonesia. As this momentous event unfolds, families will have fewer children but will invest more in the children that they do have. Education is traditionally highly prized in Asia so edtech spending will continue to skyrocket. India will likely be an epicenter for this trend. It is not aging as rapidly as China due to the absence of a one-child policy and its population is more cosmopolitan due to the fact that English is so widely spoken. As a consequence, it is uniquely situated.

There is great demand for edtech services within this country of 1.4 billion people and it also has an enormous supply of the English language-speaking professionals who are in great demand across Asia. As a consequence, venture capitalists based in Asia may be in the best position to reap the rewards of the growth in edtech.

Interested in the full research paper?

Join to receive Venture Capital research, guides, models, career tips, and many other great insights delivered straight to your inbox.